Why did I get into Real Estate an investment?

After continually investing into the stock market for the past 35 years through the ups and downs, I have realized a very nice return on my investment. I would like to say that I picked a diversified, low cost portfolio which grew on auto-pilot for those 35 years, but the reality is that I got lucky over the years and I decided that I needed to diversify a portfolio that was 95% domestic, large cap, tech heavy indices. This led me to invest in a few small business opportunities as well as build a portfolio of rental properties. This post explores what I think I am getting out of my real estate investment now that I have a few years under my belt.

Here are key reasons real estate investing beats the stock market:

1. Real estate investments can provide cash flow.

Drawing an analogy to dividend stocks, real estate can generate a steady cash flow. If you only have one or two units, you may suffer some ups and downs, but once you get into a dozen to two dozen units you have a portfolio that generates steady cash flow.

2. Return on cash invested.

There are many approaches to real estate investing, but I focus on cash flow. If I get property appreciation that keeps ahead of inflation I am happy. With a focus on cash flow, you focus on tangibles as you evaluate properties. Its much more speculative to guess at how much a property will appreciate. By looking at comparable properties and rents, you can easily model your cash flow and return on cash invested with a high degree of certainty.

3. Actively managed real estate can be less risk.

For most people, real estate investment is a substantial and illiquid investment. You tend to take the due diligence much more seriously and you tend not to panic sell like you might in the stock market. There are also more decisions you can make to influence the success of your real estate investment vs. the stock market.

I pick properties accordingly that are in good neighborhoods with a good chance to attract good tenants. These good tenants are likely to pay their rent promptly and leave the property in relatively good condition. They also act in a responsible manner with the property and the neighbors. As a landlord, you maintain the property and provide the necessary amenities to attract good tenants. You may also make certain upgrades to the property to improve safety on your property and minimize long term maintenance costs. I consider decisions on tenant selection, solid rental contracts, and proper maintenance and upgrades key to having good tenants that maximize your cash flow.

4. Real estate investing provides tax advantages.

Depreciation is the tax advantage that most investors have heard about. For dwellings, the IRS allows you to deduct the cost of the property over 27.5 years. There are also other tax benefits depending on your participation in the business and the location of your properties. I must admit I am not skilled enough with the tax options to maximize the tax benefits, but even basic tax benefits keep my tax liability reasonable.

5. Real estate investors can use leverage.

Although you can use leverage in the stock market, the typical investor will understand how to manage real estate leverage better. It is quite easy for banks to lend money support good real estate investment properties. With the proper risk management, you can feel comfortable to take on leverage which the steady cash flow can finance.

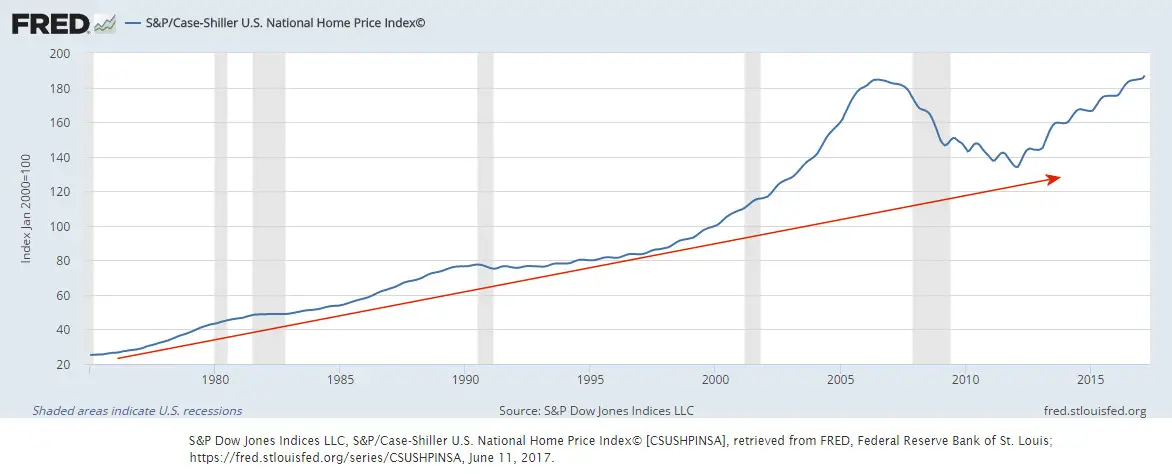

6. Inflation Hedge

Inflation averages 3% annually. Home prices typically adjust up with inflation. Although stocks don’t directly move with inflation, I consider stock portfolios to generally adjust upwards to keep up with inflation. So, I am not convinced the inflation hedge is a strong case for real estate.

7. Control of Investment

With real estate you have more levers to pull that help you pick the right property and manage to suit your investment strategy.