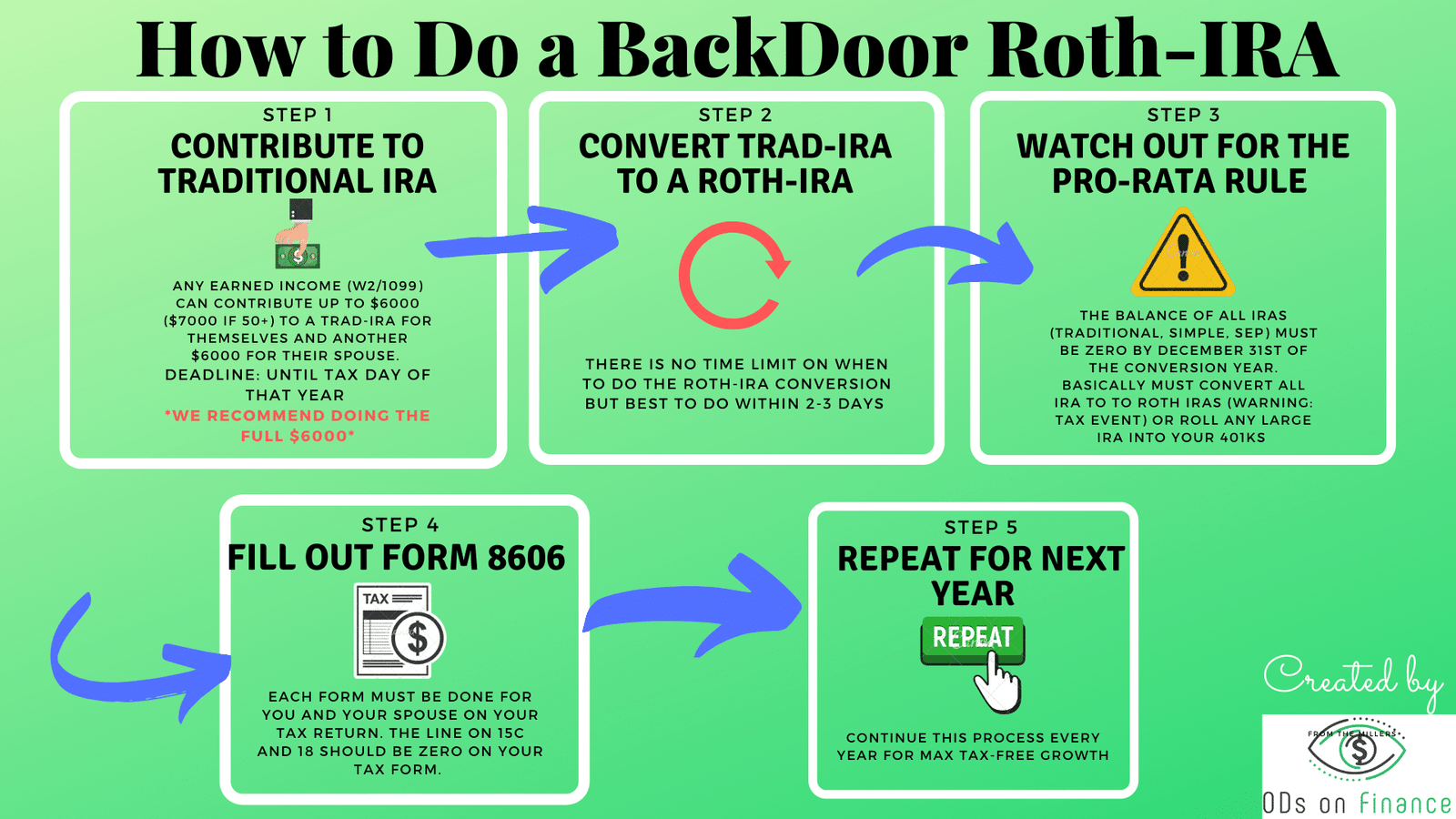

The Backdoor Roth IRA is useful for someone who cannot contribute directly to a Roth IRA because of income constraints. You do need to may taxes now for any gains you may have in the IRA account which you are using to fund the Roth IRA. But if you can get good growth out of the Roth IRA account, all of that money can be taken out for retirement on a tax free basis. Your traditional IRA gains will be taxed when you are required to take out the money for retirement. I have been funding my Roth IRA on a regular basis. I put in the standard IRA contribution and then roll it into Roth IRA almost immediately because I contribute at the end of one tax year and roll into the Roth IRA in the new tax year. This keeps my taxable gains fairly small. This approach seems to be working well for me to accumulate a steady income of federal level tax-free income in my retirement.