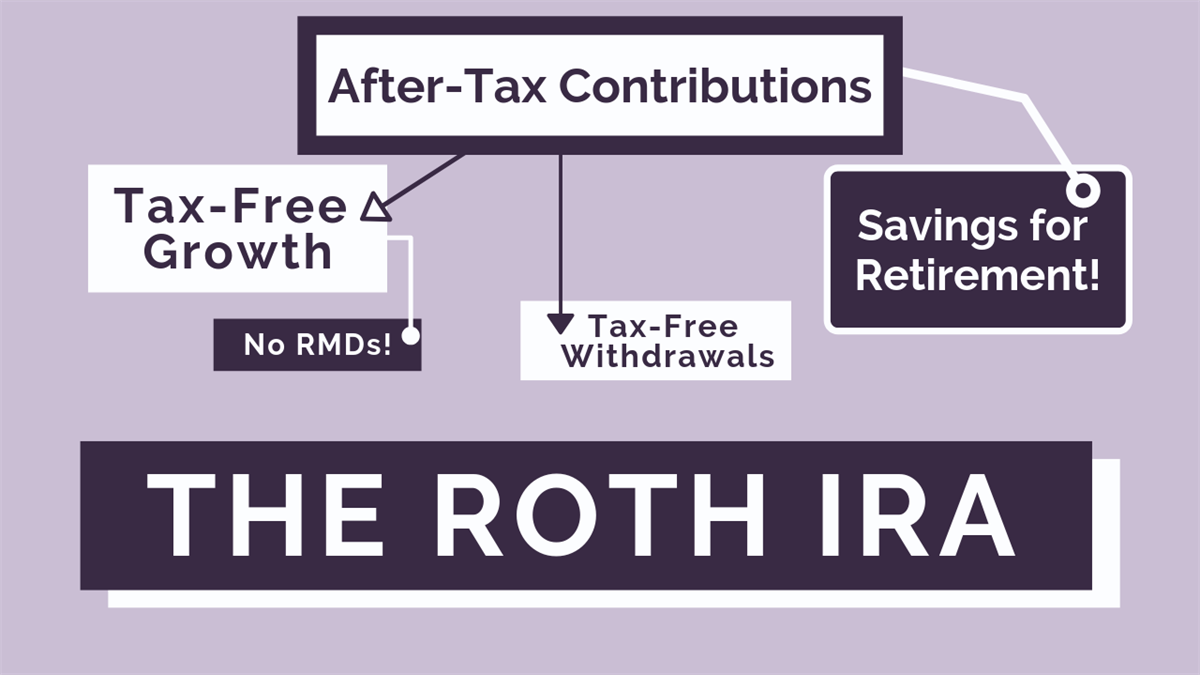

To me, Roth IRAs are a great way to get tax free growth on your income and give you good flexibility in managing your tax footprint in your retirement years. You are not forced to take out the money with Required Minimum Distributions like a traditional IRA. Your beneficiaries receive the proceeds of the Roth IRA with no tax implications. Whether by direct contributions or through a backdoor Roth IRA, I would do my best to max out my contributions to the Roth IRA.

Roth IRA vs. Traditional IRA

Individual Retirement Accounts (IRA) are savings accounts that most people use to defer taxes on pre-tax income til some point in the future when you withdraw money from the IRA. I think a traditional IRA doesn’t really provide a huge benefit. Its not clear to me whether my taxes will be higher or lower when I retire and I can defer taxes on many investments by just buying and holding til I sell the investment at a time of my choosing. On the other hand, Roth IRAs contributions are made with after-tax income, but distributions in retirement are tax free and I have the freedom to take a distribution at a time of my choosing.

Another benefit that IRAs have over some other retirement vehicles is that within each respective IRA, investment transactions and earnings (such as capital gains and dividends) are exempt from their normal taxes. This benefit allows for the possibility of well paying dividend stocks or mutual funds with frequent trading activity to be exempt from taxes.

The tax advantage from investment returns in the IRA coupled with the future tax-free distributions make Roth IRA a winner in my book. Though Roth IRAs contributions come from taxable, earned income, the long-term benefits should outweigh the short-term costs.

Roth IRA Distributions

Another benefit that Roth IRAs have is that when it comes time to withdrawal funds from the account, those distributions are tax free. You must be over the age of 59.5, and you must have established your Roth IRA for at least five years. You can also pass on Roth IRA to your beneficiaries tax-free.

The Conclusion

Roth IRA deserves consideration to be in your retirement planning toolkit. I think its best used to hold investments that normally are considered tax inefficient such as dividend stocks, REITs, and mutual funds with regular trading activity. Your normal taxable accounts can be reserved for more tax efficient investments such as growth stocks which you plan to have longer holding periods.