I saw an interesting article from Olga Kharif in Bloomberg which I attached below. If you look around the news, you see a number of worrying issues with Cryptocurrency as an investment option. It feels pretty wild west to me right now. Over time, it probably will mature and have the type of controls you might expect with other investment products. There are people that are making money in this space, but it feels like a pretty volatile bet. Take a flyer and put an amount of money you might consider going to the casino and betting it without worry. Anything more of a serious investment is best left to the professionals.

One of my concerns for the cryptocurrency market is the high amount of liquidity risk. Are cryptocurrency exchanges prepared to handle the growing demand of cryptocurrency without causing liquidity issues? Would some of the volatility seen in the traditional stock markets play out well in a cryptocurrency exchange? I am not sure that it would handle the volatility well. Liquidity concerns are compounded by difficulties in selling out as regulators try to address money laundering and fraud. What kind of spreads are you seeing on the exchanges? Big spreads and low liquidity present opportunity to make money, but also presents opportunity for market manipulation and costlier transactions.

I also think there is some element of technology risk to manage with cryptocurrency. Custody of the keys, adoption of the technology platform, cyber security are areas to concern yourself with cryptocurrency. Technology changes rapidly. If another technology becomes the in thing, any of the cryptocurrency based on older technology goes out of favor and the currency value will plummet.

Interesting article I read by Olga Kharif

What’s the world’s most widely used cryptocurrency? If you think it’s Bitcoin, which accounts for about 70% of all the digital-asset world’s market value, you’re probably wrong.

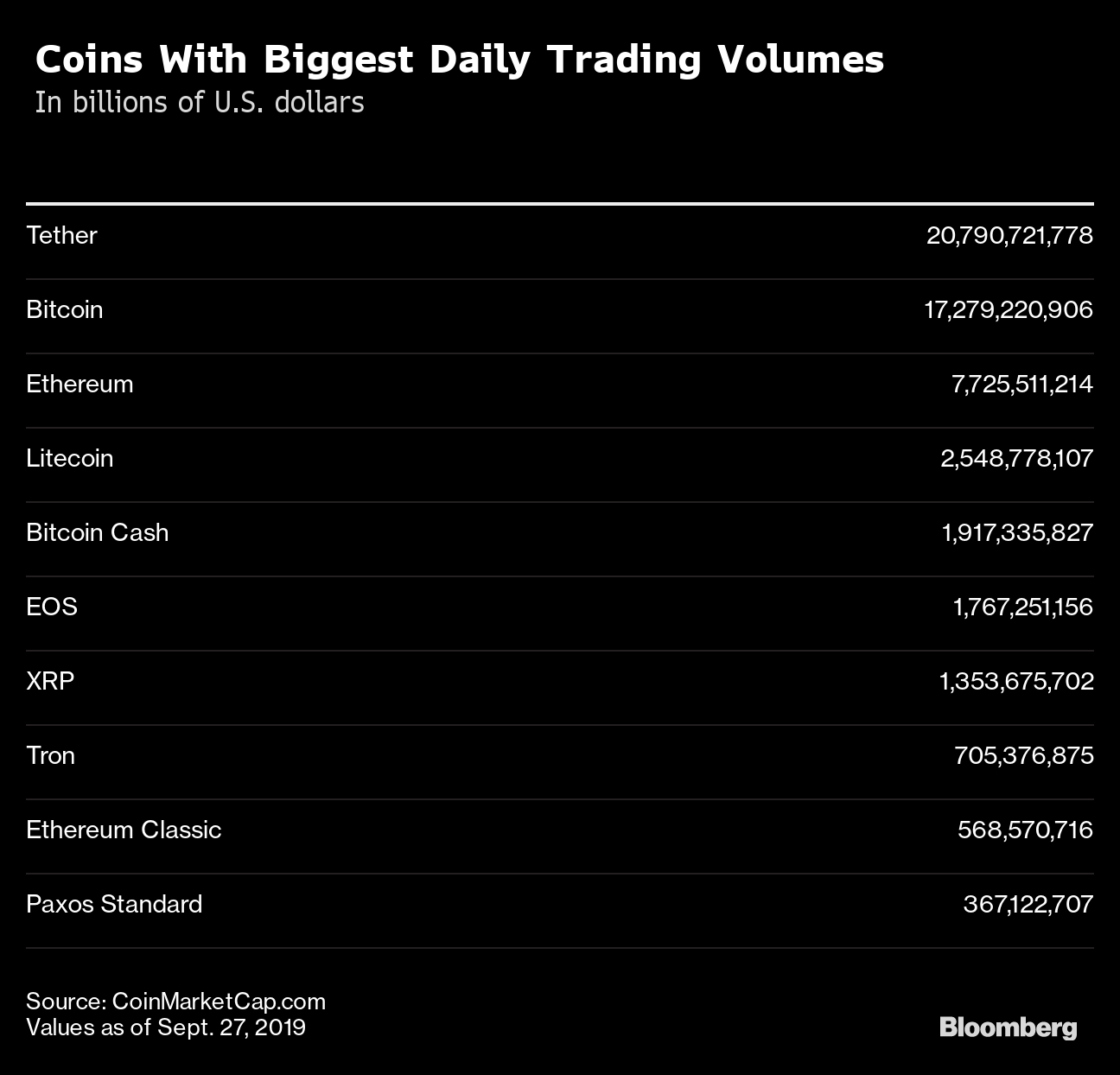

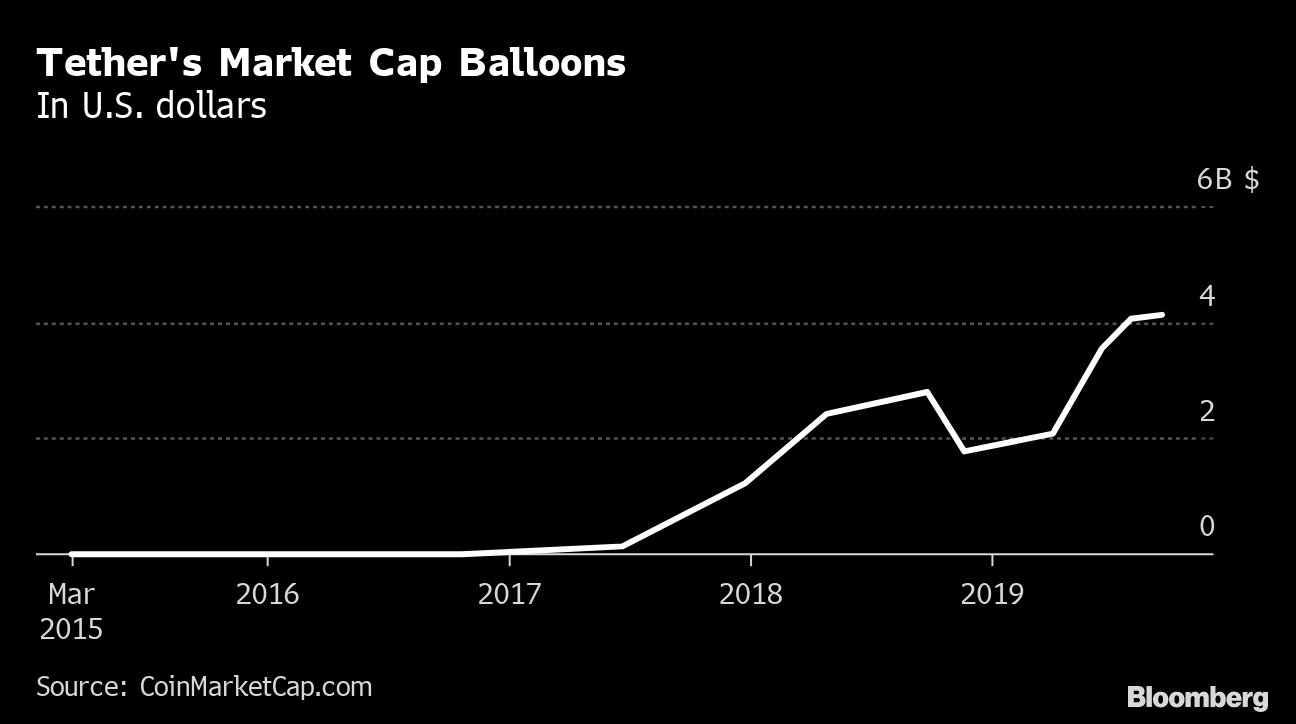

While concrete figures on trading volumes are hard to come by in this often murky corner of finance, data from CoinMarketCap.com show that the token with the highest daily and monthly trading volume is Tether, whose market capitalization is more than 30 times smaller. Tether’s volume surpassed that of Bitcoin’s for the first time in April and has consistently exceeded it since early August at about $21 billion per day, the data provider says.

With Tether’s monthly trading volume about 18% higher than that of Bitcoin, it’s arguably the most important coin in the crypto ecosystem. Tether’s also one of the main reasons why regulators regard cryptocurrencies with a wary eye, and have put the breaks on crypto exchange-traded funds amid concern of market manipulation.

“If there is no Tether, we lose a massive amount of daily volume — around $1 billion or more depending on the data source,” said Lex Sokolin, global financial technology co-head at ConsenSys, which offers blockchain technology. “Some of the concerning potential patters of trading in the market may start to fall away.”

Tether, which is being sued by New York for allegedly commingling funds including reserves, says using a know-your-customer form and approval process is required to issue and redeem the coin.

Asian traders account for about 70% of all crypto trading volume, according to Allaire, and Tether was used in 40% and 80% of all transactions on two of the world’s top exchanges, Binance and Huobi, respectively, Coin Metrics said earlier this year.

Many people don’t even know they use Tether, said Thaddeus Dryja, a research scientist at the Massachusetts Institute of Technology. Because traditional financial institutions worry that they don’t sniff out criminals and money launderers well enough, most crypto exchanges still don’t have bank accounts and can’t hold dollars on behalf of customers. So they use Tether as a substitute, Dryja said.

“I don’t think people actually trust Tether — I think people use Tether without realizing that they are using it, and instead think they have actual dollars in a bank account somewhere,” Dryja said. Some exchanges mislabel their pages, to convey the impression that customers are holding dollars instead of Tethers, he said.

The way Tether is managed and governed makes it a black box. While Bitcoin belongs to no one, Tether is issued by a Hong Kong-based private company whose proprietors also own the Bitfinex crypto exchange. The exact mechanism by which Tether’s supply is increased and decreased is unclear. Exactly how much of the supply is covered by fiat reserves is in question, too, as Tether is not independently audited. In April, Tether disclosed that 74% of the Tethers are covered by cash and short-term securities, while it previously said it had a 100% reserve.

The disclosure was a part of an ongoing investigation into Tether by the New York Attorney General, which accused the companies behind the coin of a coverup to hide the loss of $850 million of comingled client and corporate funds.

John Griffin, a finance professor at the University of Texas at Austin, said that half of Bitcoin’s runup in 2017 was the result of market manipulation using Tether. Last year Bloomberg reported that the U.S. Justice Department is investigating Tether’s role in this market manipulation.

Convenience Versus Risk

“Being controlled by centralized parties defeats the entire original purpose of blockchain and decentralized cryptocurrencies,” Griffin said. “By avoiding government powers, stablecoins place trust instead in the hands of big tech companies, who have mixed accountability. So while the idea is great in theory, in practice it is risky, open to abuse, and plagued by similar problems to traditional fiat currencies.”

On the other hand, because Tether is key to their growth, many crypto exchanges would likely be willing to bail it out if needed, said Dan Raykhman, who is developing a platform for issuing digital assets and used to be head of trading technologies for Galaxy Digital.

“There’s this implicit support from all these exchanges to help Tether stay afloat,” he said.

While dozens of stablecoins have come out in the past year, many of them independently audited and regulated, Tether remains the favorite, by far.

“Tether has been around since 2014 — ancient antecedents in crypto — and has retained its value,” said Aaron Brown, an investor and a writer for Bloomberg Opinion. “I don’t say it’s perfect, but its convenience outweighs its risk for many people.”